Benchmark Update Modestly Boosts Remodeling Market Size Projections

by Abbe Will, January 21, 2021

The Center’s Leading Indicator of Remodeling Activity (LIRA) provides a short-term outlook of national home improvement and repair spending to owner-occupied homes and is benchmarked to national spending estimates from the US Department of Housing and Urban Development’s American Housing Survey (AHS). The latest LIRA release projects national spending for remodeling and repairs to owner-occupied homes will grow to $352 billion in 2021, an increase of 3.8 percent from last year. This LIRA release also updates and revises historical spending levels and growth due to the incorporation of new benchmark data from the recently released 2019 AHS.

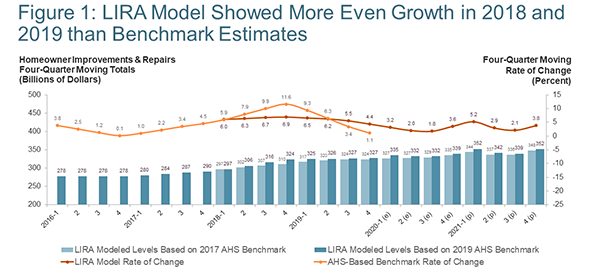

Compared to last quarter’s LIRA release, the updated LIRA now shows somewhat higher market size estimates and projections for remodeling and repair activity in 2018, 2019, 2020 and 2021. According to Center estimates based on tabulations of the latest AHS, spending growth in 2018 was more robust than the LIRA model estimated, while growth in 2019 was less robust than the LIRA modeled as seen in Figure 1. Over this two-year period, the homeowner remodeling and repair market expanded 12.8 percent from $290 billion in 2017 to $327 billion in 2019 compared to LIRA estimated growth of 11.5 percent. The slightly stronger growth in benchmark remodeling and repair spending from 2017 to 2019 has implications for the size of the market previously modeled by the LIRA model for 2018, 2019, and 2020, as well as LIRA projections for 2021. (Click charts to enlarge.)

Note: For more information about the development of the benchmark series and LIRA model, see Abbe Will, Re-Benchmarking the Leading Indicator of Remodeling Activity, JCHS Research Note, April 2016.

Source: Joint Center for Housing Studies.

Previously, the LIRA projected a homeowner improvement and repair market size of $335 billion in 2020 with spending growing to $348 billion in 2021. Now, with the replacement of AHS-based benchmark data for previously modeled estimates, the LIRA model indicates remodeling activity reached $339 billion in 2020 and projects spending will reach $352 billion this year. The implication of somewhat stronger growth in actual remodeling and repair spending from 2017 to 2019 is an expansion in market size estimates for 2020 of 1.1 percent or $3.7 billion, and a similar expansion in market size projections for 2021 of 1.1 percent or $3.8 billion.

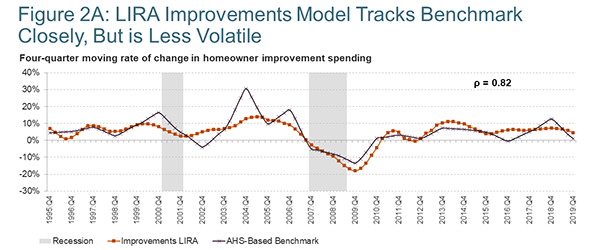

The weighted average of the LIRA inputs produces the LIRA estimates and projections seen in Figure 2A (for modeling improvement spending trends) and Figure 2B (for modeling maintenance and repair spending trends) compared to the updated AHS-based benchmark data series for 1994–2019. Overall, the LIRA model for improvements (Figure 2A) tracks the reference series very closely, but is less volatile. The estimates produced by the improvements LIRA model and the AHS-based benchmark now have a correlation coefficient of 0.82 (p-value of 0.00), barely budging from the 0.83 correlation coefficient before adding in the updated benchmark data for 2018 and 2019. And a simple regression of the LIRA output on the benchmark spending series results in an R-squared value of 0.6656, which suggests that 67 percent of the variation, or movement, in the improvements spending benchmark can be explained by the LIRA model. These values are also largely unchanged from the last time the benchmark series was updated two years ago.

Notes: ρ is the correlation coefficient ranging from -1 to +1 where -1 indicates a perfectly negative correlation, +1 a perfectly positive correlation, and 0 no correlation. The estimates produced by the improvements LIRA model and the AHS-based benchmark have a correlation coefficient (ρ) of 0.82 with a significance level (p-value) of 0.00. The significance level indicates the level of confidence that the correlation is not equal to zero, or the probability that the correlation coefficient would have arisen if the model estimates and home improvement spending were unrelated. For more information about the development of the benchmark series and LIRA model, see Abbe Will, Re-Benchmarking the Leading Indicator of Remodeling Activity, JCHS Research Note, April 2016.

Source: Joint Center for Housing Studies and NBER.

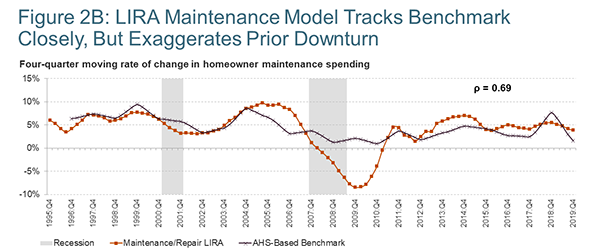

Similarly, Figure 2B compares the weighted average output of the maintenance and repair LIRA model to its AHS-based reference series. The LIRA model for maintenance has also tracked its benchmark fairly well historically and even more so after recovering from the prior downturn. The maintenance and repair LIRA and its reference series have a correlation coefficient of 0.69 (p-value of 0.00) and a simple regression of the LIRA output on the benchmark results in an R-squared value of 0.4690, which suggests that about 47 percent of the movement in the home maintenance and repair spending benchmark can be explained by this LIRA model.

Notes: ρ is the correlation coefficient ranging from -1 to +1 where -1 indicates a perfectly negative correlation, +1 a perfectly positive correlation, and 0 no correlation. The estimates produced by the maintenance LIRA model and the AHS-based benchmark have a correlation coefficient (ρ) of 0.69 with a significance level (p-value) of 0.00. The significance level indicates the level of confidence that the correlation is not equal to zero, or the probability that the correlation coefficient would have arisen if the model estimates and home maintenance spending were unrelated. For more information about the development of the benchmark series and LIRA model, see Abbe Will, Re-Benchmarking the Leading Indicator of Remodeling Activity, JCHS Research Note, April 2016.

Source: Joint Center for Housing Studies and NBER.

In 2016, the LIRA was re-benchmarked to a measure of home improvement and repair spending based on estimates from HUD’s biennial American Housing Survey. Once every two years, with new historical AHS data, the LIRA benchmark series will also be updated. Beginning with the January 2021 release, the LIRA model will be used to estimate historical spending levels since 2019 until the next biennial release of the American Housing Survey allows for actual 2020 and 2021 spending data to replace modeled estimates.